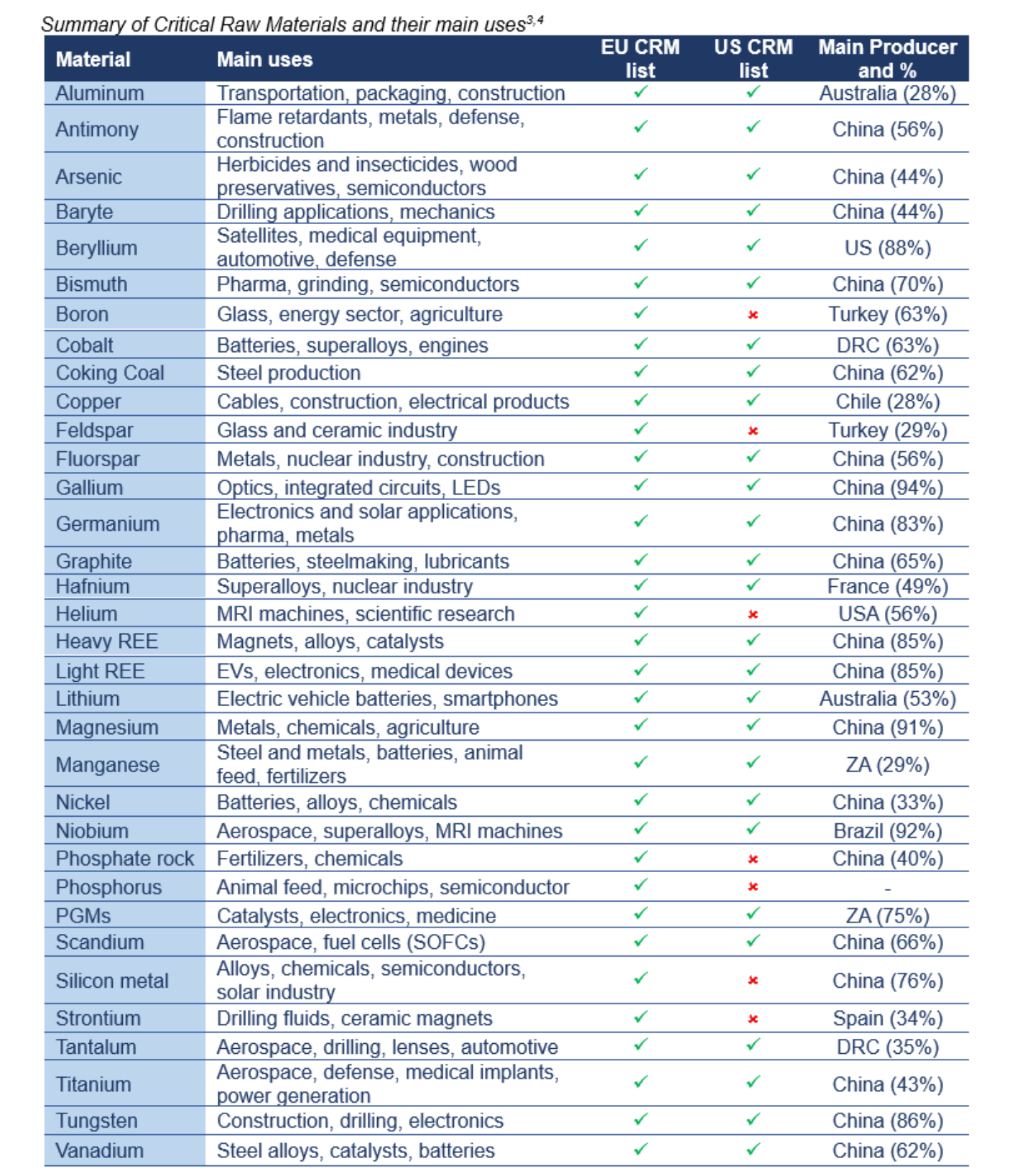

In a world shaped by rising geopolitical tensions and fragile supply chains, Critical Raw Materials (CRMs) have become a central concern for global energy and economic security. These materials underpin the technologies driving green and digital transitions, but their supply is concentrated in a few regions, creating major supply risk.

The European Union (EU) defines CRMs as raw materials that are both economically essential and subject to a high risk of supply disruption. The concept formally took shape in 2008 with the launch of the EU Raw Materials Initiative1. The first list of 14 CRMs was published in 2011, and since then, the European Commission has updated it every three years to reflect evolving production, market, and technological conditions. The most recent list, published in 2023, identifies 34 Critical Raw Materials, marking the fifth iteration of the EU’s assessment2. Among these, 17 have also been classified as Strategic Raw Materials – essential for driving the green transition, digitalization, and strengthening defense capabilities. And the EU is not alone in recognizing the strategic value of CRMs: In fact, Canada, the US and UK established their respective lists of CRMs in 2021 and 20223.

While today’s markets may appear well-supplied, the reality is that the security of critical minerals is increasingly at risk. As supply becomes more concentrated, export restrictions are multiplying. Since 2023, a growing number of measures have been introduced worldwide. In December 2024, China limited exports of gallium, germanium, and antimony to the United States, followed in early 2025 by restrictions on tungsten, tellurium, bismuth, indium, molybdenum, and seven heavy rare earth elements4.

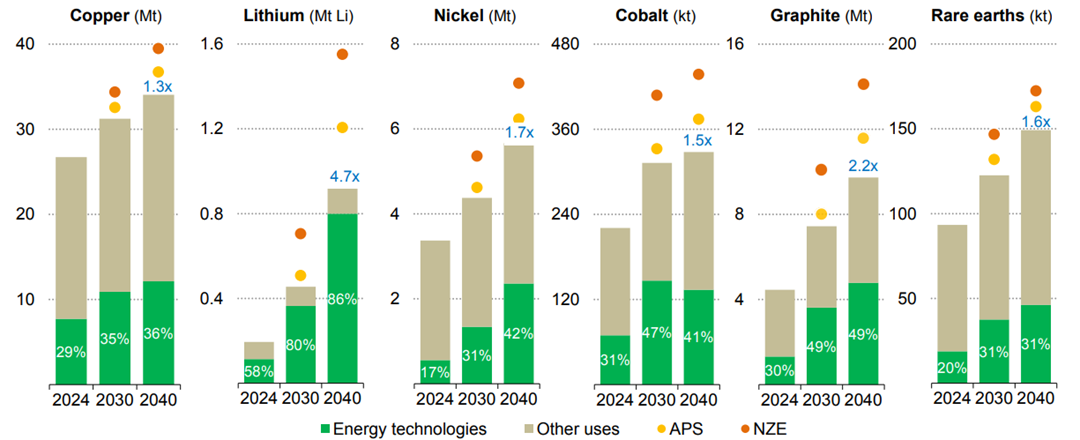

In line with these concerns, International Energy Agency (IEA) report5 states that global demand for key energy minerals is rising rapidly as the clean energy transition accelerates.

Notes: STEPS = Stated Policies Scenario; Mt = million tonnes; kt = kilotonnes; APS = Announced Pledges Scenario; NZE = Net Zero Emissions by 2050 Scenario. The figures for copper are based on refined copper (excluding direct-use scrap). Those for rare earth elements are for magnet rare earth elements only. Growth rates (in blue) are between 2024 and 2040. Source: IEA (2025), Global Critical Minerals Outlook 2025, IEA, Paris https://www.iea.org/reports/global-critical-minerals-outlook-2025, Licence: CC BY 4.0

In the Stated Policies Scenario (STEPS), lithium demand is expected to grow fivefold by 2040, while graphite and nickel are set to double. Cobalt and rare earth elements could increase by up to 60 percent, and copper demand may grow by 30 percent. This surge is driven by battery production for electric vehicles and energy storage, expanding power grids, industrial electrification, and the growing need for permanent magnets in EVs and wind turbines.

As part of its efforts to build more secure and resilient supply chains, the EU’s Critical Raw Materials (CRMs) Act sets clear targets for 20302:

- at least 10% of the EU’s annual consumption should come from domestic extraction

- at least 40% from processing within the EU

- at least 25% from recycling

- and no more than 65% of any critical raw material should come from a single third country

EPSE™ Method and CRMs recycling

Mining and metal industry effluents often contain significant concentrations of Critical Raw Materials (CRMs), either individually or as multimetal streams. These metals pose environmental risks and have considerable economic value. The EPSE™ Method effectively removes these metals in a single step, forming a multimetal precipitate. Depending on the metal concentrations, the resulting sludge may hold economic value and be processed to recover valuable metals. For instance, EPSE™ Method has successfully treated effluents with several grams of copper per liter, producing sludge rich in copper for extraction. A recent case also demonstrated the precipitation of base metals along with rare earth elements (REEs) from mine pit water.

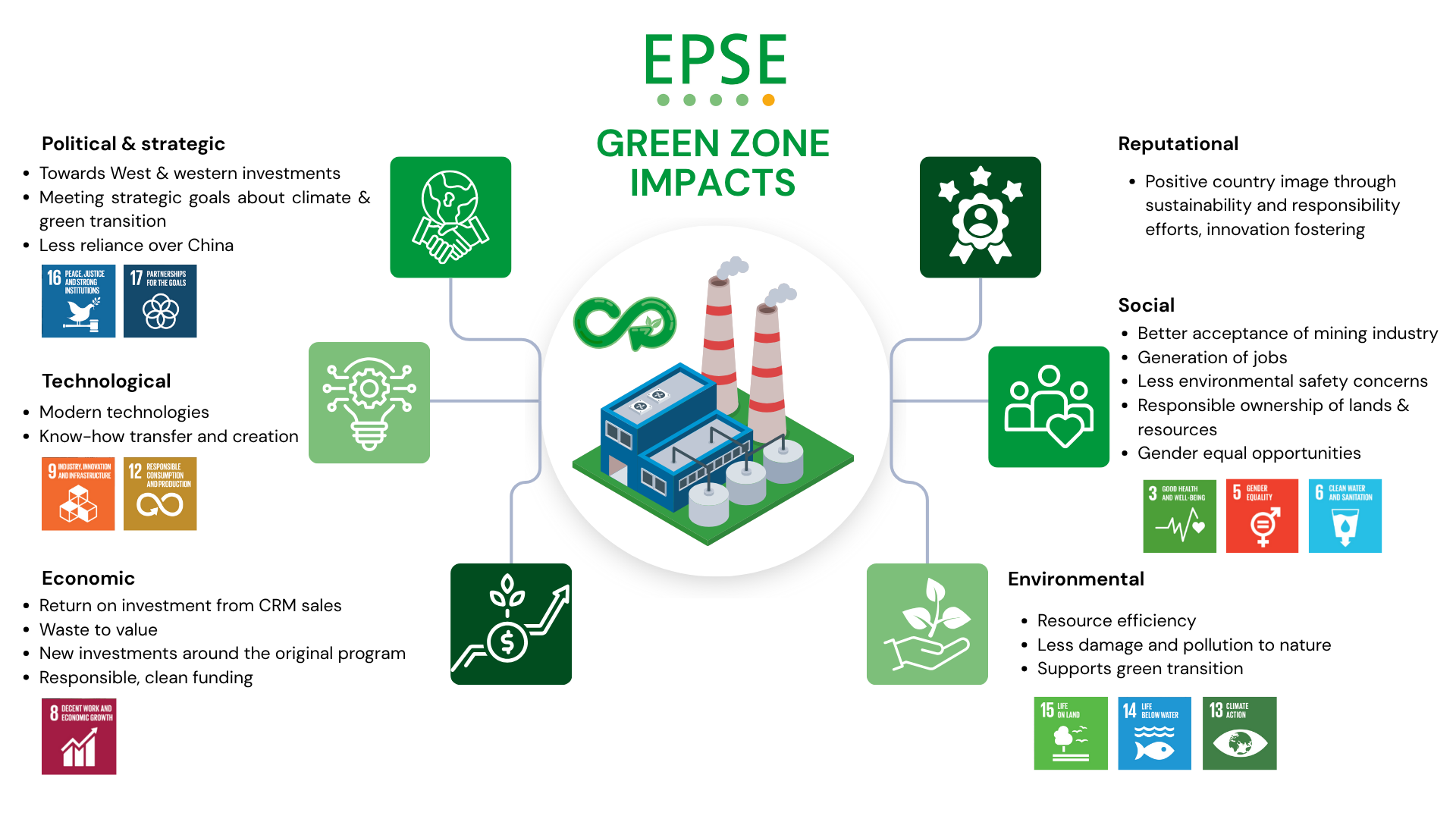

The Green Zone

Green Zone is a recycling plant based on modern technologies, including EPSE Technology, for mining side and waste streams. The processes generate valuable materials for reuse. The plant’s guiding principles are Zero Discharge, i.e., no wastewater, but recycling water into the process, and Waste to Value, i.e., generating value from waste. Volumes in the mining industry are enormous, and in addition to wastewater, thousands or even hundreds of thousands of tons of various waste streams such as slags, filter ashes, and tailings are generated annually. Recovering valuable raw materials from these waste streams requires expertise, but the result has positive impacts not only on the environment, local people and the economy, but also politically due to the strategic importance of CRMs. Read more about the Green Zone here.

The impacts of the Green Zone by theme. The impacts of the Green Zone can also be examined through the UN’s Sustainable Development Goals (SDGs).

References

- Zhang, S. E., Bourdeau, J. E., Nwaila, G. T., & Ghorbani, Y. (2023). Emerging criticality: Unraveling shifting dynamics of the EU’s critical raw materials and their implications on Canada and South Africa. Resources Policy, 86, 104247.

- European Commission: Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs, Study on the critical raw materials for the EU 2023 – Final report, Publications Office of the European Union, 2023, https://data.europa.eu/doi/10.2873/725585.

- Allianz SE. (2023, August 1). Critical raw materials – Is Europe ready to go back to the future? [PDF report]. Munich, Germany: Allianz SE. Retrieved from [www.allianz.com].

- Geological Survey of Finland. (n.d.). Critical and strategic raw materials. Retrieved October 21, 2025, from https://www.gtk.fi/en/current/critical-and-strategic-raw-materials/

- IEA (2025), Global Critical Minerals Outlook 2025, IEA, Paris https://www.iea.org/reports/global-critical-minerals-outlook-2025, Licence: CC BY 4.0.

This article is written by

Khawer Shafqat

Solution Manager

khawer.shafqat(a)epse.fi